Potential Tax Issues in Divorce

Posted on April 18, 2017 in

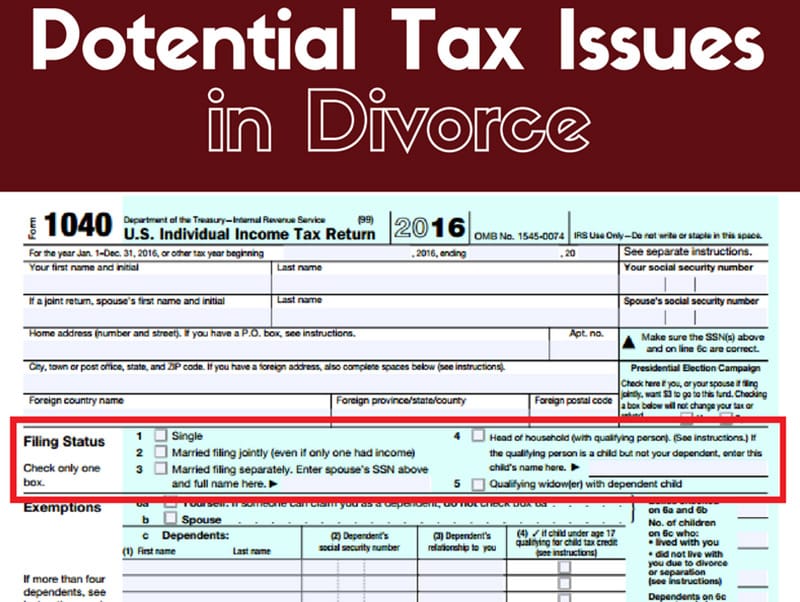

During this tax season, you may have questions about which “marital status” box to check when filling out your tax forms, or how your divorce may affect your taxes. How you file could impact your income tax rate for 2016, or the amount of your expected refund.

Essentially, there are five different choices of filing status: 1) single, 2) married filing jointly, 3) married filing separately, 4) head of household, and 5) qualifying widow(er) with dependent child(ren). While you may qualify for more than one of these choices within the year, you can only choose one filing status on your tax return.

Your marital status, for tax purposes, is based on your marital status on the last day of the Tax Year (December 31 of the previous year). So, for example, if you were engaged the majority of 2016, but got married in November 2016 (meaning you were married on December 31, 2016), your marital status for the entirety of 2016 would be “married.” Similarly, if you were divorced on December 28, 2016, then you were divorced by December 31, 2016, so you are considered unmarried for the whole 2016 tax year even though you were actually married for most of it.

Married

The IRS considers someone “married” if: 1) they are legally married and living with their spouse or 2) they are legally married but living apart, and have not formally separated.

“Married” persons have two options on filing their tax returns. They can file Married Filing Jointly, which is when the two spouses agree to file their taxes together. The married couple can also file Married Filing Separately, which is when each spouse wants to be responsible for their own tax liability only and have their refund issued to them individually. While Married Filing Jointly may offer more overall financial benefit to a couple, Married Filing Separately may be a good option for people who are already in a divorce proceeding or who are living separately and prefer to manage their finances separately.

Unmarried

The IRS considers someone “unmarried” if: 1) they are single, never married, 2) they are legally separated under a decree of divorce or separate maintenance, or 3) they are unmarried, or considered unmarried and qualify for Head of Household status.

Note, living separately (often referred to as “in a bona fide state of separation”) in not the same as being legally separated. Georgia law does not recognize the concept of “legal separation” as a separate status while the divorce is pending. To be legally separated in Georgia, you need to complete a legal action called a separate maintenance. Separate maintenance is available for couples who wish to remain married, but want to live apart from each other. This domestic relations action is similar to divorce in that it protects a spouse’s rights to custody, visitation, support, and use of marital property – but it does not dissolve the marriage.

“Unmarried” persons have three options in filing their tax returns, two of which are relevant to persons ending their marriage by divorce. They can file Single, which means that person was not married on December 31 of the tax year and they do not qualify for any other filing status. The person can file Head of Household if they are not married, or are considered unmarried and paid for more than half of the costs of household upkeep, and had a “qualifying person” (a dependent child or relative in their care).

Divorcing? Here Are Some Issues to Consider

An attorney can help you negotiate tax issues in your divorce, but for the financial impact of tax issues, you should talk to an accountant. Discussion with your accountant will help inform your goals on tax issues in your divorce.

If you are getting divorced close to the end of the calendar year, you may want to negotiate when you and your spouse will seek to have the divorce finalized by the Court. If filing as “Single” will be better for you than filing “Married Filing Jointly” or “Married Filing Separately,” then you may want to try to complete the divorce before December 31. Alternatively, you may want to negotiate that even after you have reached a settlement, you will not finalize the divorce until after January 1 of the next year, so that you can file your taxes as married.

If you are getting divorced before your previous year’s tax returns have been filed, (which does happen often, especially if the couple has filed a tax extension through October) you want to negotiate whether you will file jointly or separately for the previous tax year. You also want to determine how you will divide any refund, if you file taxes jointly.

If you are in the process of divorcing, and want to split the previous year’s joint tax return, please note that the IRS will not get involved in marital issues. There are no rules as to how those funds are to be divided; the parties can parse out the tax return however they want. Some couples will calculate how much of a refund each spouse would have earned (if they had filed separately), and then split the tax return that way. Others will list the tax refund on their joint-owned marital assets sheet and then negotiate the allocation at a later date.

During the process of divorce, you should also address any potential liability incurred during the years you filed taxes jointly with your spouse. You want to ensure that both parties will be responsive and cooperative in the event of an audit. You will also want to negotiate in what proportion the parties will be responsible for any deficiencies in tax years where you filed jointly. While no one expects to get audited, agreeing to how you will handle such an event in advance can make the process of being audited with your ex-spouse a little less painful.

If you have any questions about negotiating tax issues in your divorce, call Porchlight at (678) 435-9069 or contact us here. Porchlight does not provide tax advice. For tax advice and the tax impact of a divorce, you should seek advice from a C.P.A. or other tax consultant.